The list of GST state codes comprises exclusive codes assigned by the government to each state and Union Territory, which are sequentially numbered. Each state and Union Territory is denoted by a unique code. For example, the state of Maharashtra is represented by GST state code 27, while Karnataka is represented by code 29. The utilization of state codes gained significance with the inception of GST in India.

The state codes facilitate the identification of the operational area or headquarters of any business. As per the GST regulations, a business with operations in multiple regions within the same state should register under a single state code. Below is a list of GST state codes that we have compiled for your reference. Please have a look.

GST State Code List

Here is the list GST state code.

| States | GST State Code | Alpha Code |

|---|---|---|

| Himachal Pradesh | 02 | HP |

| Punjab | 03 | PB |

| Chandigarh | 04 | CH |

| Uttarakhand | 05 | UA |

| Haryana | 06 | HR |

| Delhi | 07 | DL |

| Rajasthan | 08 | RJ |

| Uttar Pradesh | 09 | UP |

| Bihar | 10 | BR |

| Sikkim | 11 | SK |

| Arunanchal Pradesh | 12 | AP |

| Nagaland | 13 | NL |

| Manipur | 14 | MN |

| Mizoram | 15 | MZ |

| Tripura | 16 | TR |

| Meghalaya | 17 | ML |

| Assam | 18 | AS |

| West Bengal | 19 | WB |

| Jharkhand | 20 | JH |

| Odisha | 21 | OR |

| Chattisgarh | 22 | CG |

| Madhya Pradesh | 23 | MP |

| Gujarat | 24 | GJ |

| Dadra And Nagar Haveli And Daman And Diu | 26 | DD,DN |

| Maharashtra | 27 | MH |

| Andhra Pradesh | 28 | AP |

| Karnataka | 29 | KA |

| Goa | 30 | GA |

| Lakshadweep | 31 | LD |

| Kerela | 32 | KL |

| Tamil Nadu | 33 | TN |

| Puducherry | 34 | PY |

| Andaman and Nicobar Islands | 35 | AN |

| Telangana | 36 | TS |

| Andhra Pradesh | 37 | AP |

| Ladakh | 38 | LA |

| Other Territory | 97 | OT |

GST State Code List PDF Download

Download List of GST state code from below link.

http://etdut.gov.in/exciseonline/misc/gst_hsn-sac_codes.pdf

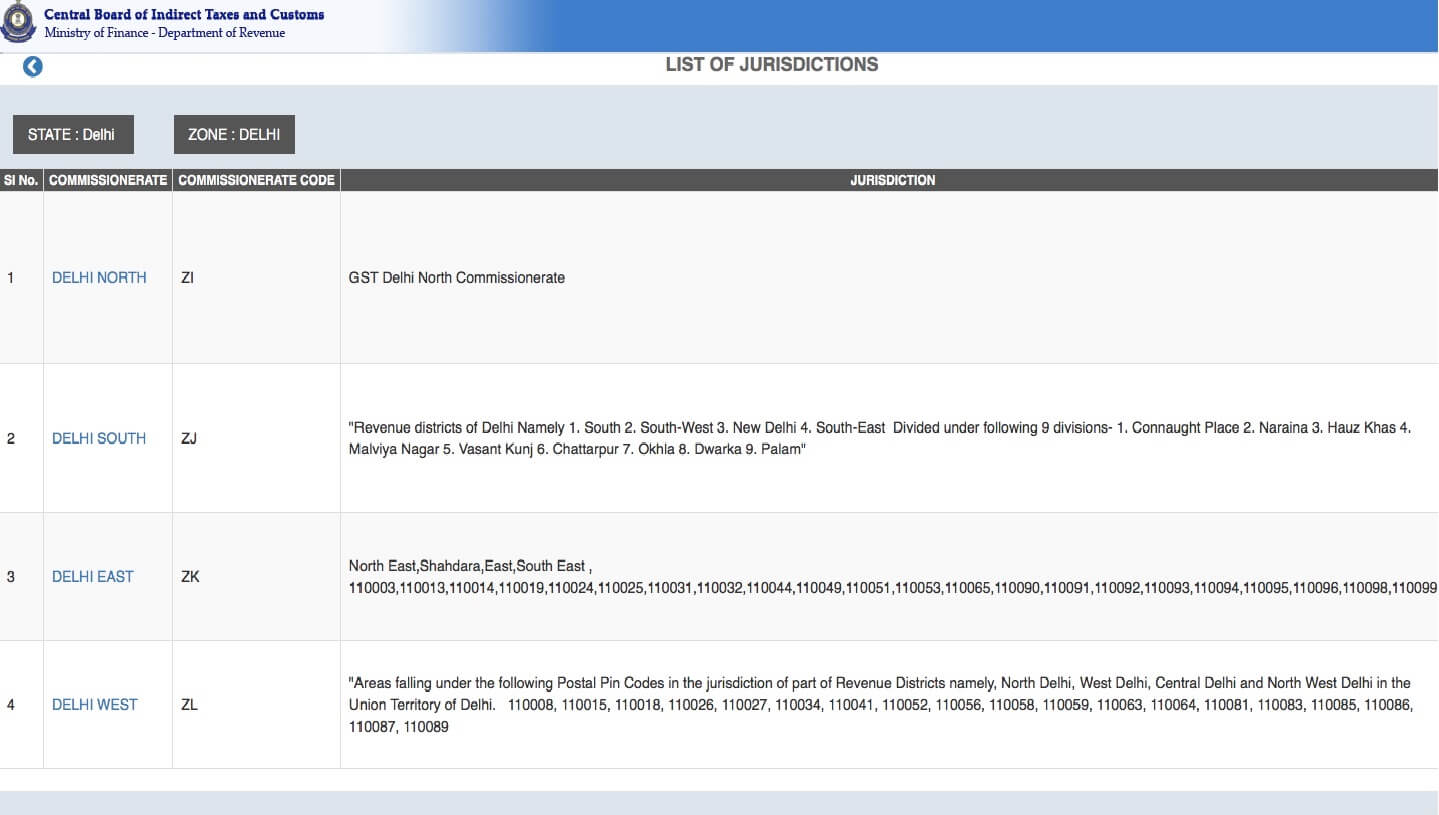

State Jurisdictions in GST

Prior to acquiring GST registration, taxpayers may need to determine their corresponding state jurisdiction. This involves referring to the website of the respective state’s commercial tax, VAT, or sales tax department to locate the ward and circle that will determine the state jurisdiction.

STEP 1: Visit Ministry of Finance Department of Revenue official portal https://cbic-gst.gov.in/cbec-portal-ui/?knowYourJuris.

STEP 2: Click on your state link from the list of sate and union territories.

STEP 3: Select the relevant zone by clicking on its name.

STEP 4: Once you have selected the zone, a list of commissionerates will appear on the screen. Click on the commissionerate that pertains to you.

STEP 5: Subsequently, a list of sub-commissionerates/divisions will be displayed on the screen. Click on the relevant sub-commissionerate/division.

STEP 6: A list of jurisdiction ranges will be presented to you, providing further details regarding the jurisdiction that applies to your business.

Read :

List of 29 States of India with Formation Dates and Years | List UT in India PDF